Shopify, the leading e-commerce platform, has recently hit a remarkable $100 billion milestone, raising questions about its future growth and whether it’s the right time for investors to buy. This article aims to provide a Shopify stock forecast based on recent trends, financial reports, and market analysis.

1. Shopify’s Journey to $100 Billion:

Shopify’s journey to this massive milestone has been nothing short of extraordinary, driven by its relentless focus on innovation, customer-centric approach, and robust business model.

1.1. The Early Years

Shopify was a little start-up at first, fighting to establish itself in the fiercely competitive e-commerce sector. But investors and companies alike soon started to take notice of its creative solutions.

1.2. Growth and Expansion

Shopify’s growth trajectory took off as it kept adding new services and reaching out to companies of all kinds. Its market worth grew gradually until hitting the $100 billion threshold a while back.

2. Analyzing the Current Market Position:

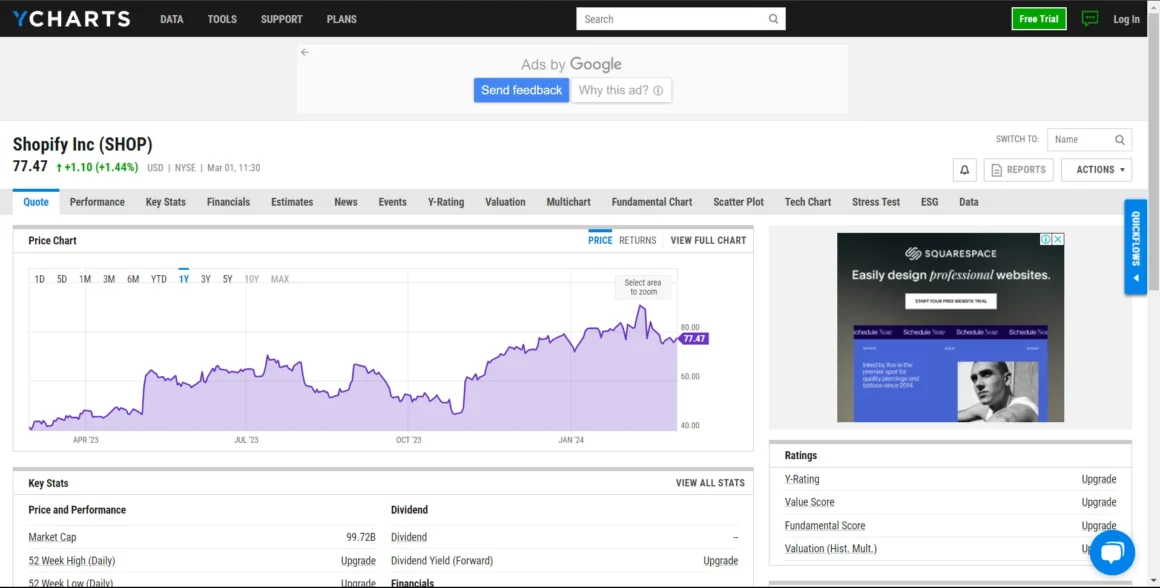

Shopify has a strong market position right now, and its share price has been rising steadily. Before making a choice, investors need take into account a number of things.

2.1. Financial Performance

Shopify has demonstrated remarkable financial success, showcasing steady revenue growth and a robust balance sheet.

2.2. Competitive Landscape

Shopify has succeeded in carving out a space for itself in spite of fierce competition from industry heavyweights like Amazon and eBay, largely because of its distinctive value offer.

3. The Shopify Stock Forecast:

The Shopify stock forecast looks promising, with several analysts predicting continued growth. However, investors should approach with caution given the inherent volatility of the stock market.

3.1. Short-term Forecast

Shopify’s stock is anticipated to continue rising in the near future. On the other hand, this could be impacted by future market swings and economic concerns.

3.2. Long-term Forecast

In the long term, Shopify’s prospects look bright, driven by its strong fundamentals and potential for future growth.

4. Should You Buy Shopify Stock Now?

Purchasing Shopify stock should be the result of a thorough evaluation of a number of variables, such as the company’s development potential, market position, and financial standing.

4.1. Considerations for Investors

For investors, considerations should include Shopify’s current share price, its future growth potential, and the investor’s own risk tolerance.

4.2. Final Verdict

While Shopify’s future looks promising, the decision to invest should be a carefully considered one, taking into account both the rewards and risks involved.

5. Shopify’s Performance in Recent Years

Over the past few years, Shopify has seen a steady growth. The following table shows the year-over-year growth rate of Shopify’s revenue:

| Year | Growth Rate (%) |

| 2017 | 73 |

| 2018 | 59 |

| 2019 | 47 |

| 2020 | 86 |

6. Conclusion

Reaching the $100 billion mark is definitely an outstanding achievement for Shopify. But the topic of whether now is a good moment to buy Shopify stock needs to be carefully considered and analyzed. As an investor, you should always keep in mind that, although the possibility of large returns is alluring, the risks are as substantial.

“Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” – Paul Samuelson

Remember, the Shopify stock forecast is just a prediction based on available data, and the actual performance could vary significantly. Therefore, always make well-informed investment decisions.